html

Xiaomi Tops China’s Smartphone Market in Q1 2025: A Detailed Analysis

1. Market Overview: Xiaomi Leads with Strong Growth

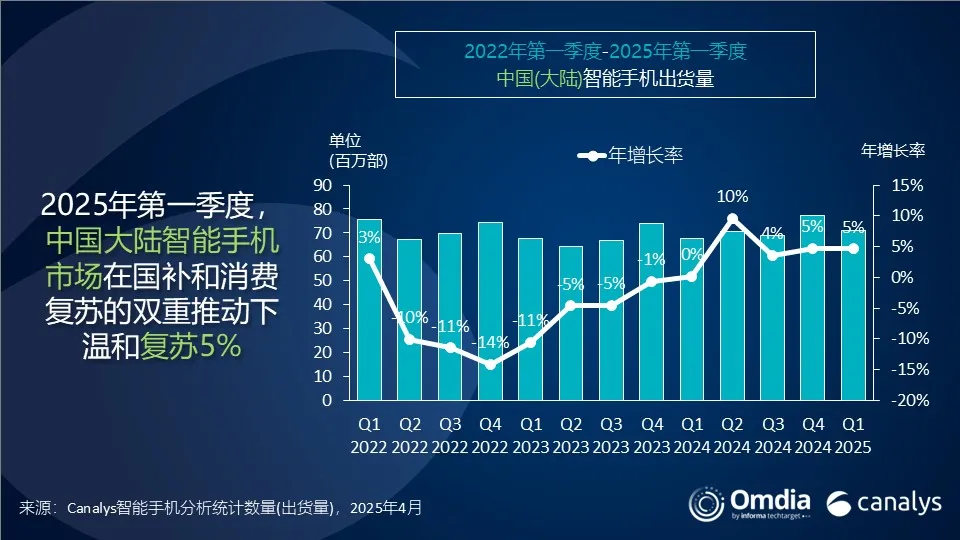

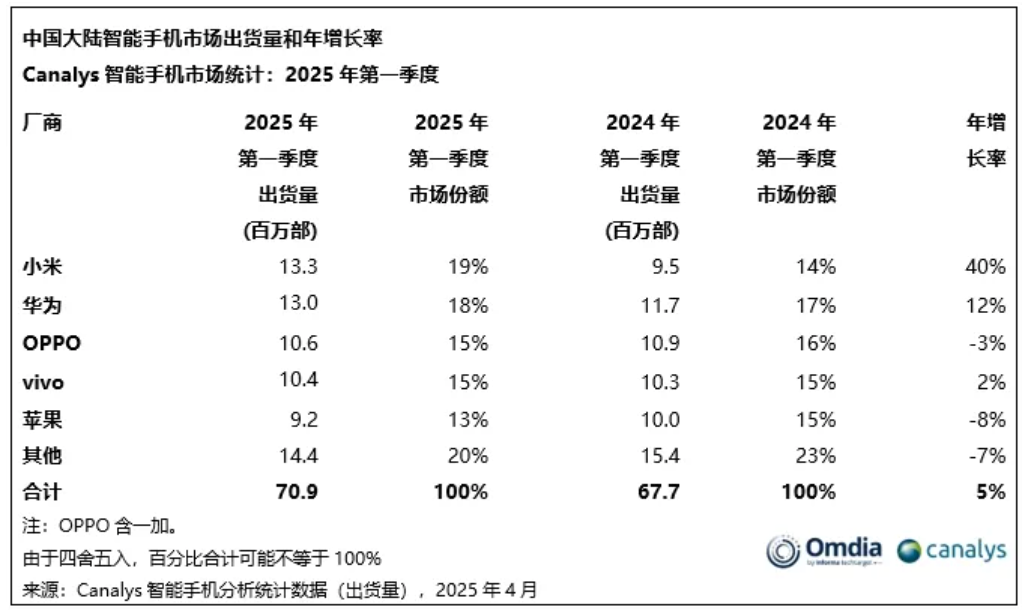

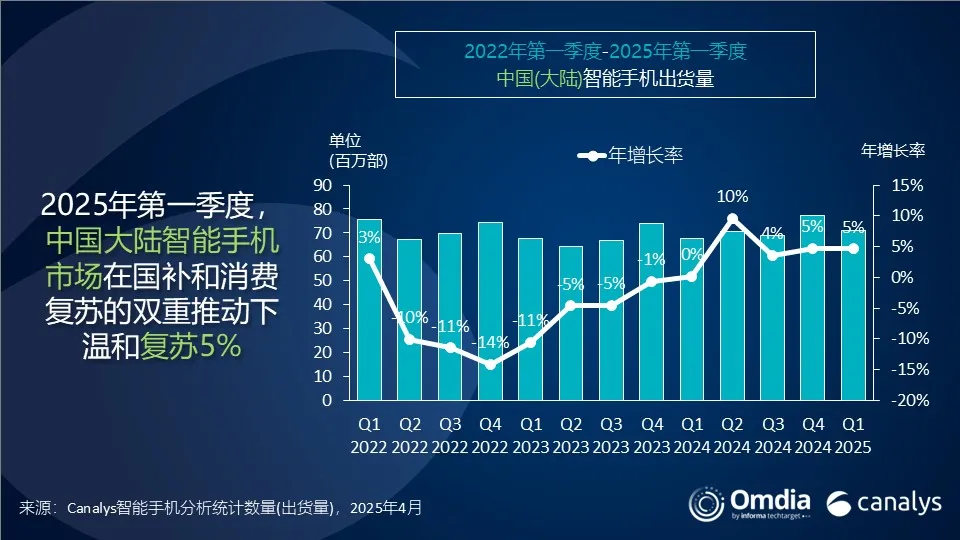

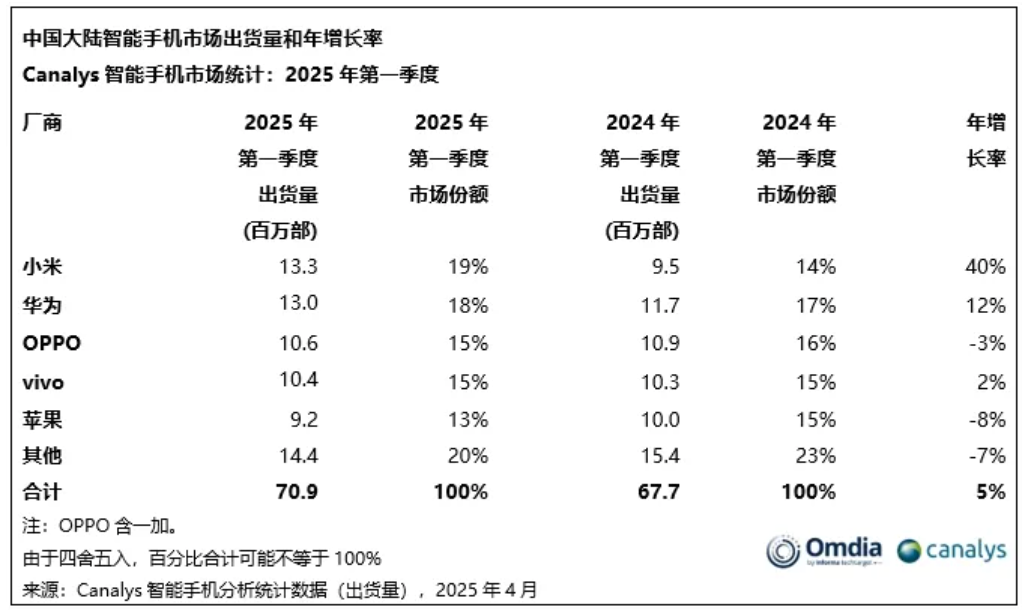

The latest smartphone shipment report for mainland China in the first quarter of 2025 (January-March) reveals exciting changes in the competitive landscape. According to data from Canalys, total smartphone shipments reached 70.9 million units during this period, marking a 5% year-over-year increase. Analysts attribute this growth to government subsidy programs and a rebound in consumer spending.

For the first time in two years, Xiaomi claimed the top spot in China’s smartphone market, shipping 13.3 million units and capturing 19% of the market share. This represents a remarkable 40% growth compared to the same period in 2024. Huawei followed closely with 13 million units (18% share), while OPPO, vivo, and Apple rounded out the top five.

2. Breakdown of Top Brands in Q1 2025

Here’s a detailed look at the performance of major smartphone brands in China during Q1 2025:

① Xiaomi

- Shipments: 13.3 million units

- Market Share: 19%

- Yearly Growth: +40%

② Huawei

- Shipments: 13 million units

- Market Share: 18%

- Yearly Growth: +12%

③ OPPO

- Shipments: 10.6 million units

- Market Share: 15%

- Yearly Growth: -3%

④ vivo

- Shipments: 10.4 million units

- Market Share: 15%

- Yearly Growth: +2%

⑤ Apple

- Shipments: 9.2 million units

- Market Share: 13%

- Yearly Growth: -8%

Other brands combined accounted for 14.4 million units (20% share), down 7% from 2024.

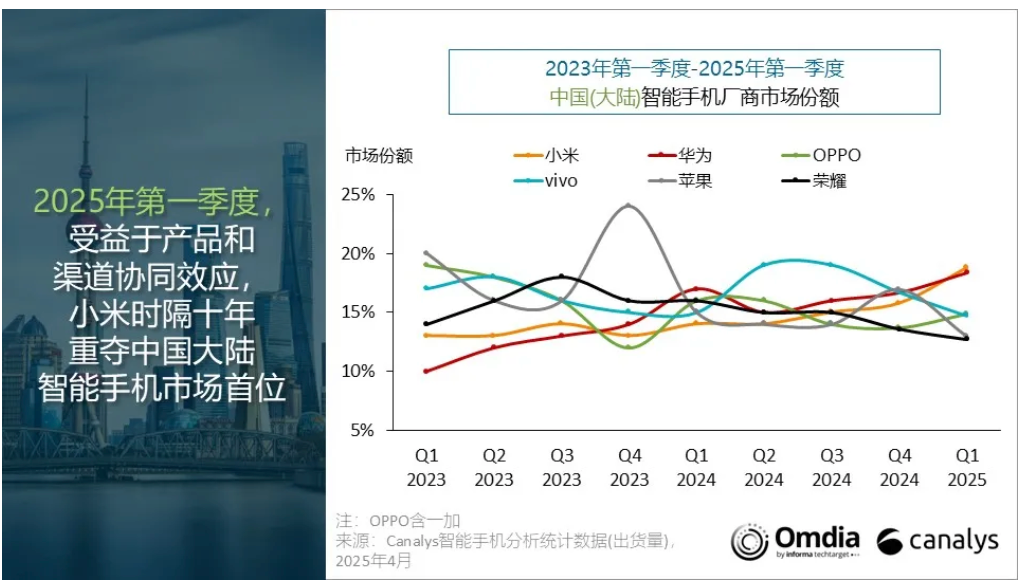

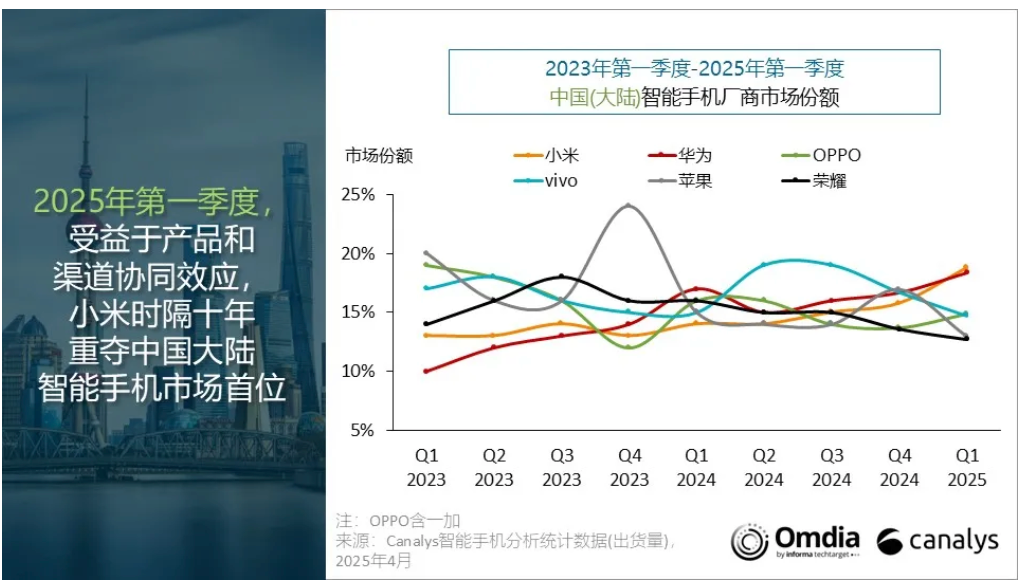

3. Xiaomi’s Comeback: A Decade in the Making

Canalys highlights that Xiaomi’s return to the No. 1 position marks its first time leading the Chinese market in over a decade. Analysts credit this success to Xiaomi’s “coordinated product and distribution strategies.” The brand’s unified pricing across online and offline channels reportedly reduced decision-making complexity for consumers, especially under government subsidy policies.

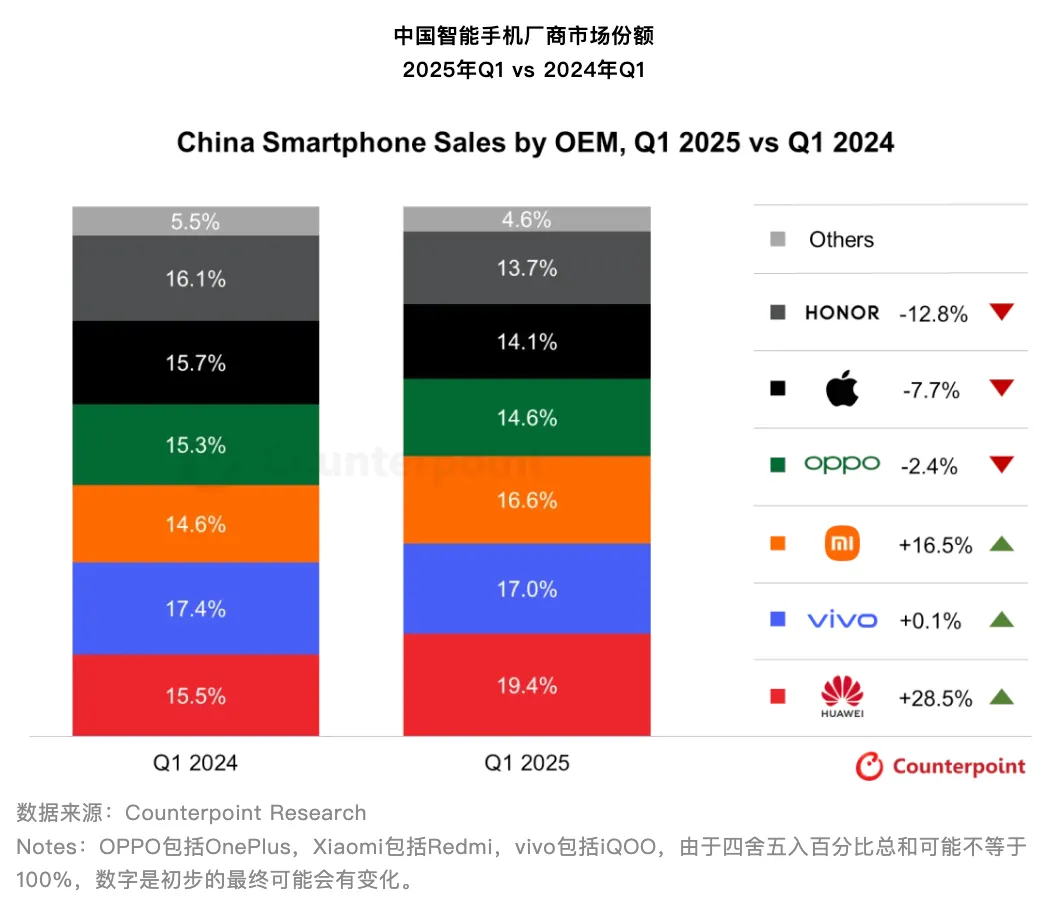

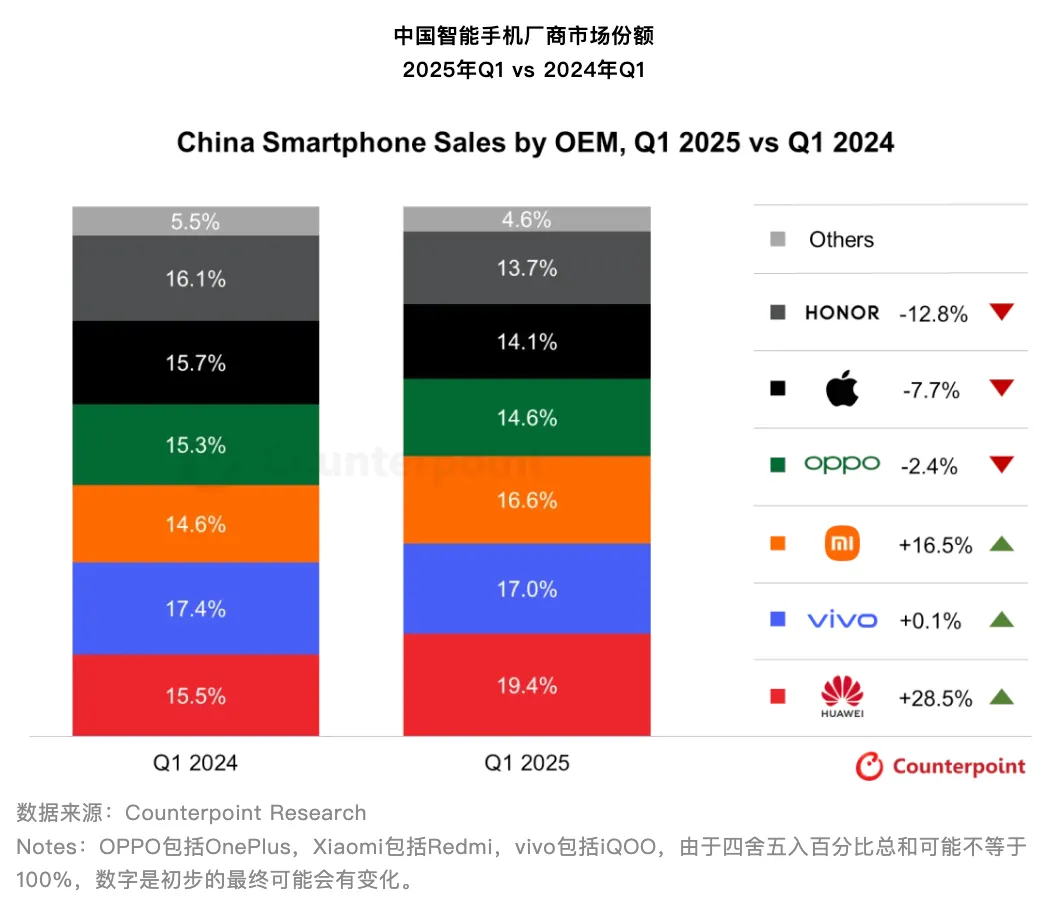

4. Counterpoint’s Q1 2025 Data: Slight Variations

Another research firm, Counterpoint, released slightly different figures for the same period. Here’s their ranking:

① Huawei

- Share: 19.4%

- Growth: +28.5%

② vivo + iQOO

- Share: 17%

- Growth: +0.1%

③ Xiaomi + Redmi

- Share: 16.6%

- Growth: +16.5%

④ OPPO + OnePlus

- Share: 14.6%

- Decline: -2.4%

⑤ Apple

- Share: 14.1%

- Decline: -7.7%

⑥ Honor

- Share: 13.7%

- Decline: -12.8%

Other brands accounted for 4.6% of the market. Differences in data collection methods between research firms may explain these variations.

5. Vivo X200 Ultra: Repair Costs Revealed

In related news, vivo recently launched its flagship X200 Ultra and published official repair prices for out-of-warranty services. Below are the costs (converted to USD for international readers):

- Screen Replacement: $200–$255

- Battery Replacement: $28

- Back Cover Replacement: $49

- Motherboard Replacement: $441–$546 (varies by storage capacity)

- Front Camera: $17

- Rear Cameras:

- Main Camera: $63

- Wide-Angle Camera: $63

- Periscope Telephoto Camera: $115

- Other Accessories:

- Charger: $29

- Data Cable: $10

6. After-sales Service and Recycling

vivo also provides after-sales service standards, including free replacement for certain parts under warranty and discounted rates for out-of-warranty repairs.

Additionally, an app called “闪小白App” offers fair and transparent recycling services for electronic devices.

7. Government Subsidies and Promotions

The Chinese government is offering subsidies for 3C digital products, with discounts of up to 15% on select smartphones.

8. Database Updates

Finally, “小白测评数据库4.5” has been updated, providing consumers with valuable information for purchasing decisions.

Image List