html

The Coffee Wars: How Luckin Underestimated Cudi and Lost Its Edge

1. Introduction: A Battle Brewing in China’s Coffee Market

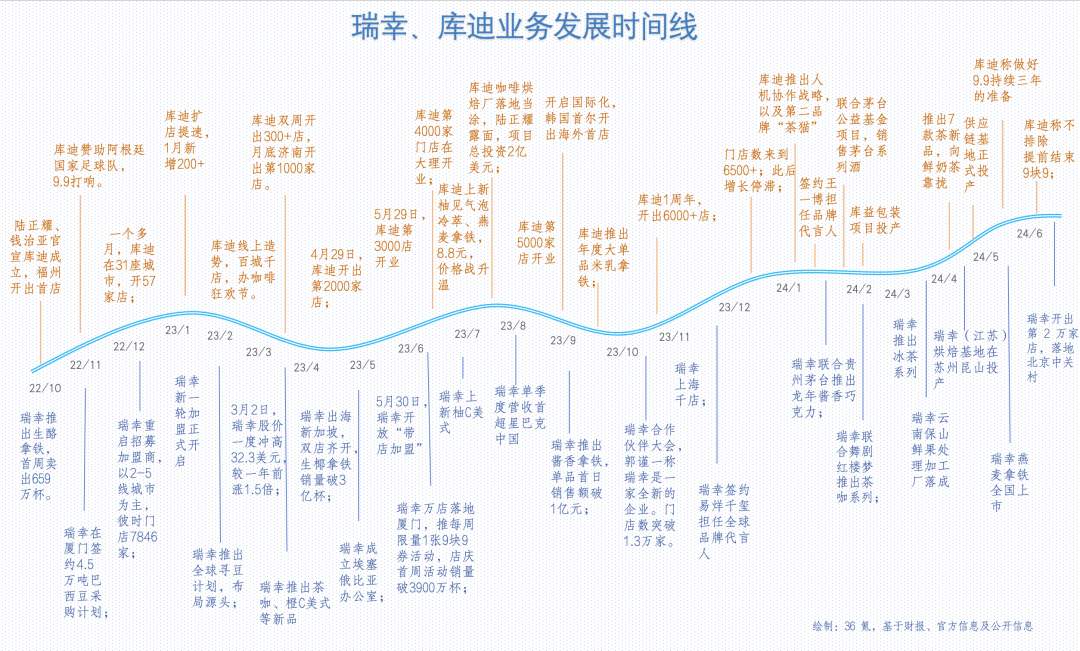

In the bustling world of China’s coffee industry, two prominent brands—Luckin Coffee and Cudi Coffee—are locked in a fierce battle for dominance. What began as a simple price war over $1.38 (9.9 RMB) coffee has spiraled into a full-fledged struggle for survival. This article delves into how Luckin Coffee, once China’s largest coffee chain, underestimated its newfound rival, Cudi, and allowed it to emerge as a formidable threat.

2. Underestimating the Enemy

“Luckin’s only rival is Starbucks.” – Guo Jinyi, Luckin’s CEO

In early 2023, Luckin’s CEO, Guo Jinyi, confidently dismissed Cudi as a mere competitor. At the time, Luckin was on the rebound from a financial fraud scandal, its stock price had doubled, and it was laser-focused on surpassing Starbucks in revenue. Guo’s declaration was clear: Cudi was not a threat.

Cudi, founded by Lu Zhengyao (Luckin’s disgraced former chairman), was initially seen as a sideshow. Despite Cudi’s aggressive $1.38 pricing and rapid expansion to 2,000 stores, Guo believed Lu’s new venture posed no real danger. “He knows Cudi’s products and team inside out. Lu can’t hurt Luckin anymore,” a source close to Luckin told 36Kr.

But Lu had other plans. While publicly criticizing Luckin’s leadership as “traitors,” he quietly built Cudi into a 6,000-store chain within two years—nearly matching Starbucks’ China footprint.

3. Luckin’s Strategic Missteps

3.1 Delayed Response to the Price War

When Cudi launched its $1.38 coffee in late 2022, Luckin hesitated to retaliate. Its major shareholder, Centurium Capital (which holds 32.4% of Luckin’s shares), blocked the move, fearing it would harm profitability and delay Luckin’s relisting on U.S. stock markets.

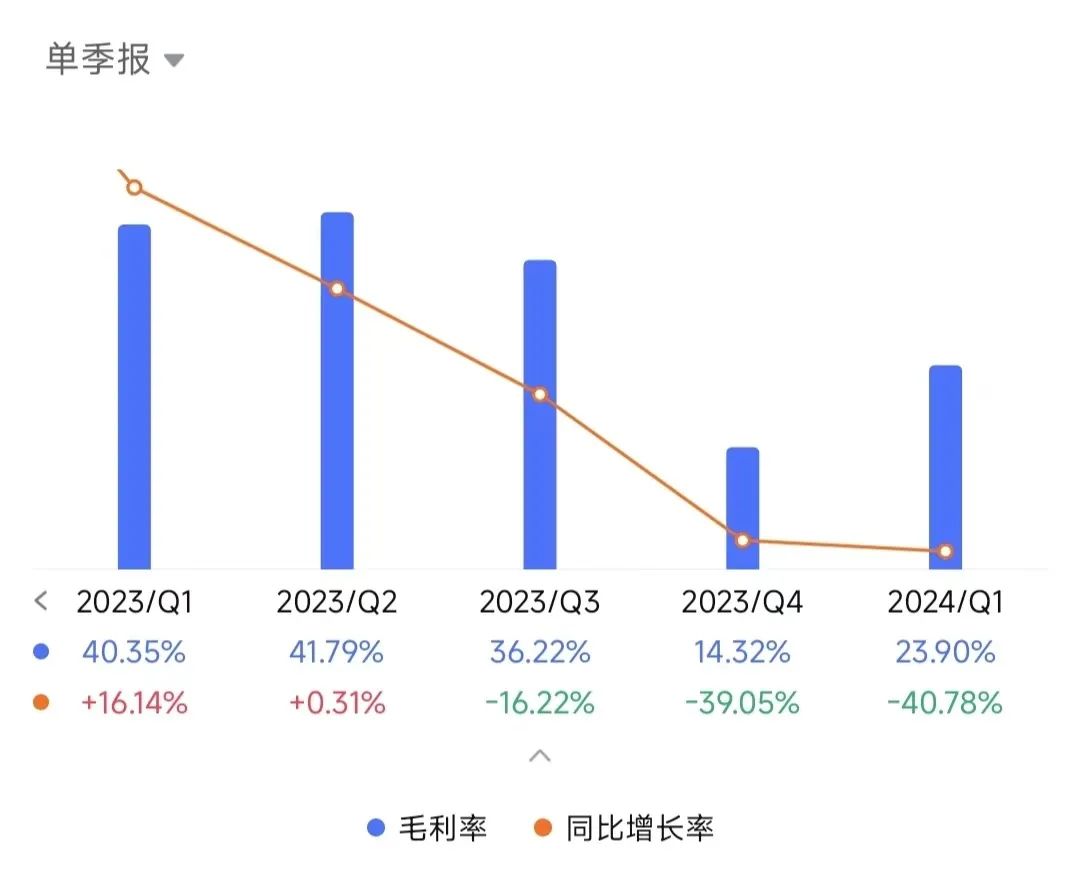

By Q3 2023, Luckin had no choice but to match Cudi’s pricing. The results were catastrophic:

- Average cup prices dropped from $1.80 (13 RMB) to $1.38 (9.9 RMB).

- Operating profit margins plunged to -1% in Q1 2024.

- Same-store sales fell by 20% as new stores cannibalized existing ones.

“If Luckin had fought back earlier, Cudi wouldn’t exist today,” an industry insider lamented.

3.2 Overexpansion Backfires

To counter Cudi, Luckin rushed to open 7,754 new stores in six months—equivalent to Starbucks’ total stores in China after 25 years. But this “store density strategy” backfired, hurting existing franchisees:

- Rent costs soared as Luckin outbid Cudi for prime locations.

- Sales at older stores dropped by 50% due to overcrowding.

4. Cudi’s Playbook: A Crowdfunded Challenger

4.1 Copying Luckin’s Blueprint

Cudi’s rise was no accident. Lu Zhengyao replicated Luckin’s playbook with key twists:

- Franchise-first model: Unlike Luckin’s early focus on company-owned stores, Cudi relied on franchisees from day one.

- Aggressive recruitment: Cudi poached Luckin’s employees, offering promotions (e.g., regional managers became city heads).

- Shared systems: Cudi’s store management software, supplier networks, and even product launches mirrored Luckin’s.

“Cudi’s team acts like they already have 5,000 stores. They know the game,” said a supplier who worked with both brands.

4.2 The $1.38 Secret: Subsidies and Scale

Cudi’s rock-bottom pricing relied on heavy subsidies:

- $1.38 coffee actually cost franchisees $1.80 (12.5 RMB) to make.

- Cudi’s headquarters covered the gap by slashing its own profits.

To sustain this, Lu raced to cut costs:

- Renegotiated supplier contracts every 3 months, demanding 10% price cuts.

- Built in-house factories to reduce reliance on third parties.

5. Why Cudi Survived (For Now)

5.1 Franchisee Loyalty

Cudi’s franchisees are scrappy small business owners, not corporate managers. When Cudi shifted from “headquarters-managed” to “owner-operated” stores in 2024, profits improved:

- Labor costs dropped by 40% as owners replaced salaried staff.

- Store hours flexed to match local demand.

“A $1.38 coffee only works if you sweat every penny,” said a Shanghai franchisee.

5.2 Luckin’s Weaknesses

- Higher costs: Luckin’s coffee beans cost 20% less than Cudi’s, but its bloated store network erased this advantage.

- No knockout punch: Cudi lacks a signature product (like Luckin’s “Coconut Latte”), but its low prices keep customers hooked.

6. The Stalemate: No Winners in a Price War

Both brands are trapped:

- Luckin can’t raise prices without losing market share.

- Cudi can’t afford to stop subsidies without franchisee rebellions.

Meanwhile, new players like Lucky Coffee (backed by ice cream giant Mixue) are testing $0.95 (6.6 RMB) coffee, squeezing margins further.

7. Key Lessons for Beginners

- Speed matters: Cudi’s rapid scale (6,000 stores in 2 years) forced Luckin into defensive mode.

- Franchisees are fighters: Owner-operated stores outperform corporate-managed ones in cost-cutting.

- Price wars are poison: Short-term gains hurt long-term profitability.

8. What’s Next?

- Luckin must innovate beyond price cuts. Its recent “Moutai Latte” (baijiu-infused coffee) shows promise.

- Cudi needs a breakout product to justify higher prices.

- Consumers win—for now. But industry-wide losses could lead to market consolidation.

“No one gets rich in a race to the bottom,” warned a beverage industry investor.