html

Lawson Convenience Store: The Silent Revolution in China’s Retail Industry

1. Introduction: A Bizarre Phenomenon in China’s Convenience Stores

In the bustling retail landscape of China, particularly in the Jiangsu-Zhejiang-Shanghai (江浙沪) region, a silent revolution is underway. Lawson Convenience Store, a global chain with over 15,000 outlets worldwide, is reshaping the industry with an unconventional strategy: reverse under-labeling. This means products often weigh significantly more than their labeled net weight, offering customers a surprising value proposition.

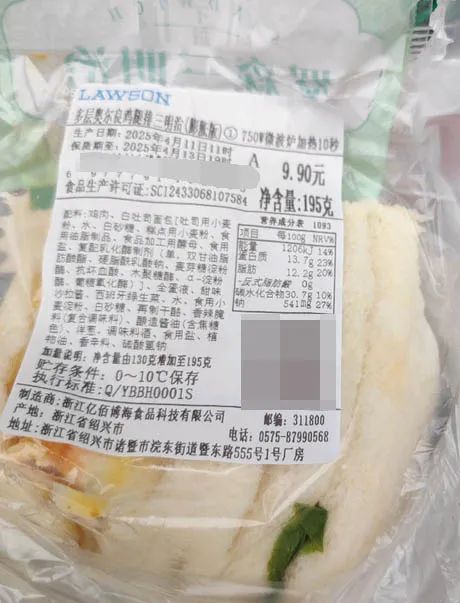

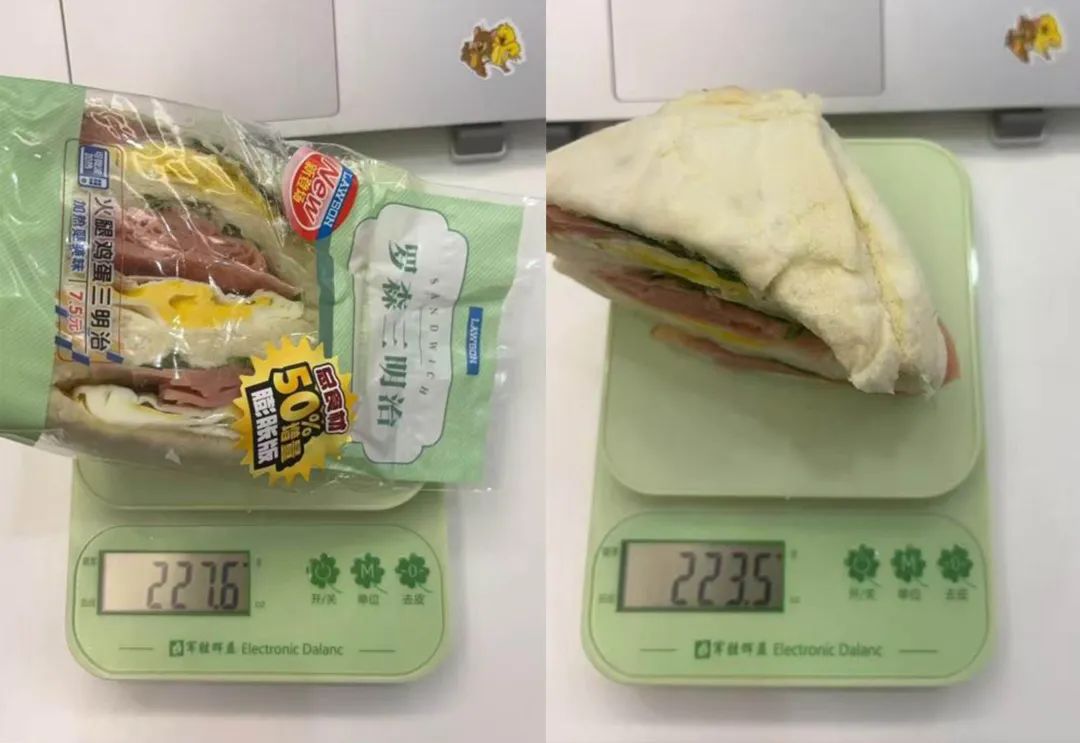

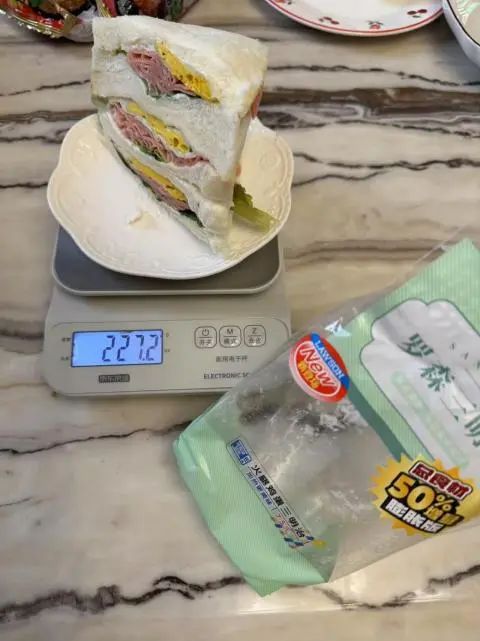

For instance, a ¥9.9 ($1.40) multi-layer chicken sandwich labeled as 195g might actually tip the scales at 268g—nearly 40% more. This quirky approach has not only stunned customers but also sent shockwaves through the industry, prompting questions about profitability, consumer trust, and the future of retail competition.

2. Reverse Under-Labeling: How Lawson Dominates with Generous Portions

2.1 The “Secret Sauce”: More Food, Same Price

Lawson’s strategy defies conventional retail logic. Instead of cutting costs or lowering prices, they’re doubling down on quantity. Here’s a glimpse into how it works:

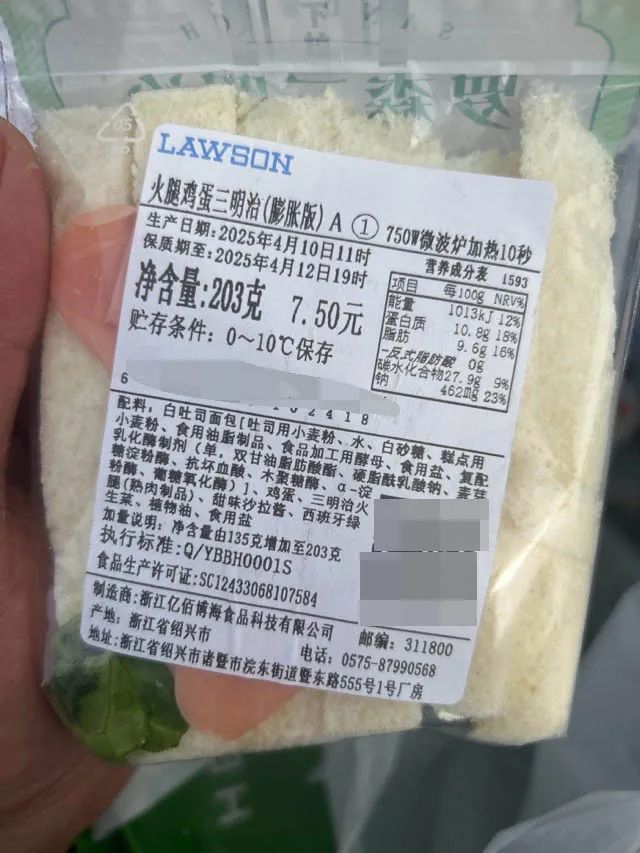

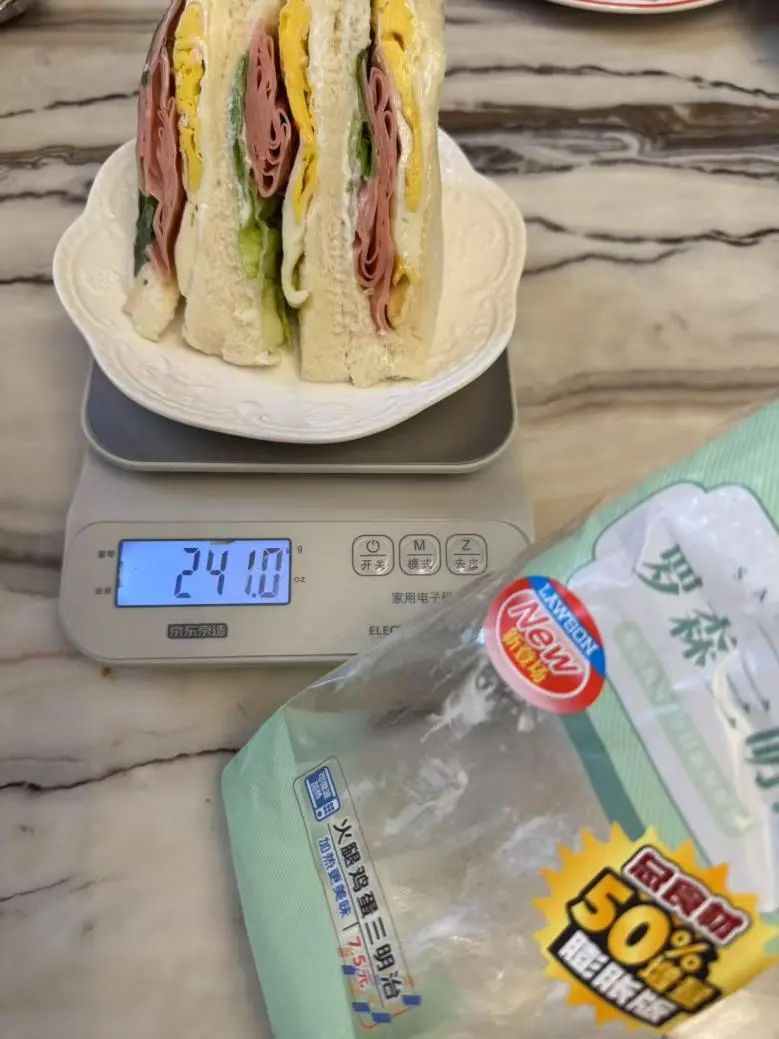

- Ham & Egg Sandwich: Labeled 203g, priced at ¥7.5 ($1.05). Actual weight often exceeds 240g.

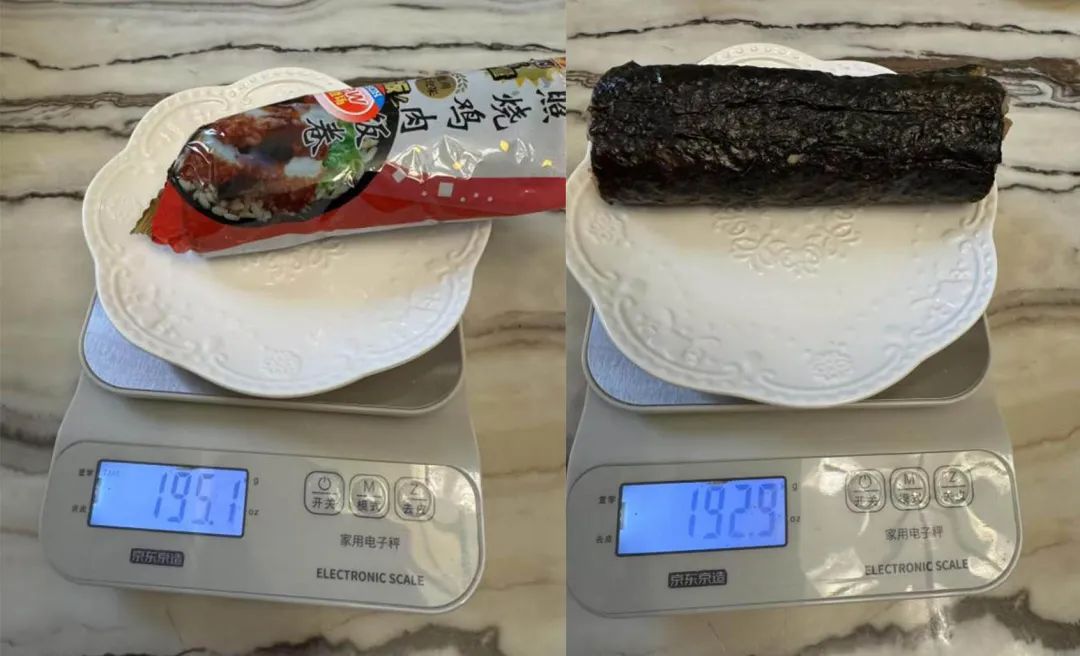

- Teriyaki Chicken Rice Roll: Labeled 175g, priced at ¥6.9 ($0.97). Customers frequently find it closer to 210g.

- Large Rice Ball: Labeled 195g, but scales reveal 215g post-packaging.

This isn’t a one-off occurrence; it’s a systemic approach. Employees are trained to stuff ingredients aggressively, transforming sandwiches into “six-layer feasts” and rice rolls into “diamond-packed” meals. The result? Customers feel they’re getting 50% more food for the same price, a deal that’s hard to resist.

2.2 Why Competitors Panic

For rival convenience stores, Lawson’s approach is nothing short of catastrophic. It’s not just about the extra food; it’s about the perception of value:

- Consumer Perception: A Lawson sandwich leaves customers full for hours, while competitors’ smaller portions feel inadequate.

- Cost Pressure: Adding 30-50% extra ingredients without raising prices seems unsustainable. Yet Lawson’s scale (6,300+ stores in China) allows bulk purchasing, offsetting costs.

- Brand Loyalty: Customers joke, “If I starve to death, it won’t be at Lawson”—highlighting its reputation for reliability and value.

3. The Ripple Effect: Disrupting the Convenience Store Ecosystem

3.1 Consumer Reactions: Delight and Confusion

Lawson’s strategy has sparked a range of reactions among consumers:

- Positive Feedback: Many praise Lawson for its generosity. A ¥10 ($1.40) meal rivals street food in value, attracting budget-conscious students and office workers.

- Health Concerns: Fitness enthusiasts mockingly blame Lawson for weight gain: “I only eat three Lawson sandwiches a day—why am I gaining 10 pounds?”

3.2 Industry Backlash

Competitors are left with impossible choices:

- Match Lawson’s Portions: Risk bankruptcy due to thinner margins.

- Stick to Standard Sizes: Lose customers to Lawson’s perceived “better deals.”

One store owner lamented: “Our rice balls look like kids’ snacks next to Lawson’s.”

4. Behind the Scenes: Lawson’s Bold Gamble

4.1 Profitability Mystery

How does Lawson afford this? Clues include:

- Supply Chain Mastery: As part of Japan’s Mitsubishi conglomerate, Lawson leverages bulk purchasing and efficient logistics.

- Hidden Savings: Reducing packaging waste or optimizing ingredient ratios might offset costs.

- Long-Term Vision: Sacrificing short-term profits to dominate market share.

4.2 Employee Culture

Workers describe a “stuffing frenzy” in kitchens. One employee joked: “We’re not making sandwiches—we’re building skyscrapers.” This culture of excess aligns with Lawson’s motto: “Keep customers full, keep competitors scrambling.”

5. Global Context: Lessons from Lawson’s Strategy

5.1 Comparison with 7-Eleven and FamilyMart

While 7-Eleven and FamilyMart focus on consistency and speed, Lawson bets on quantity over precision. This disrupts the “race to the bottom” trend in retail, proving that generosity can be a differentiator in a crowded market.

5.2 Implications for Western Markets

Could this work elsewhere? Considerations include:

- Cultural Preferences: Asian markets prioritize value-for-money; Western consumers might prioritize organic or premium options.

- Regulatory Hurdles: Strict labeling laws in the U.S. or EU could penalize under-labeling.

6. The Future: Will Lawson’s Gamble Pay Off?

6.1 Sustainability Challenges

Lawson’s model faces several challenges:

- Rising Ingredient Costs: Global food inflation could strain margins.

- Consumer Fatigue: Overeating concerns might deter health-conscious buyers.

6.2 Opportunities

Despite the challenges, Lawson sees opportunities:

- Expansion: Plans to reach 10,000 stores in China by 2025.

- Innovation: Introducing healthier options or tech-driven services (e.g., app-based loyalty programs) could diversify its appeal.

7. Conclusion: A New Era for Retail

Lawson’s reverse under-labeling isn’t just a gimmick—it’s a calculated strike at industry norms. By prioritizing customer satisfaction over razor-thin margins, Lawson challenges rivals to innovate or perish. As one netizen quipped: “Lawson isn’t selling sandwiches; it’s selling happiness.”

Whether this strategy leads to long-term dominance or a cautionary tale remains to be seen. But for now, Lawson’s shelves—and customers’ stomachs—are fuller than ever.

Keywords: Lawson Convenience Store, reverse under-labeling, food portion, competitive strategy, retail disruption, China market, consumer loyalty.