html

Trump’s New Tariff Policy Sparks Global Market Chaos – Apple Faces Brunt of Economic Shockwave

Introduction: The Domino Effect of Protectionist Policies

President Trump’s “reciprocal tariff” strategy has sent seismic waves through global financial markets, creating unprecedented volatility from Asian trading floors to Wall Street. Technology titan Apple finds itself at the epicenter of this economic storm, with investors and consumers alike bracing for significant disruptions. This deep dive explains the policy mechanics, immediate market reactions, and strategic implications for global consumers.

1. Worldwide Stock Markets in Freefall

1.1 Asian Indices Lead the Decline

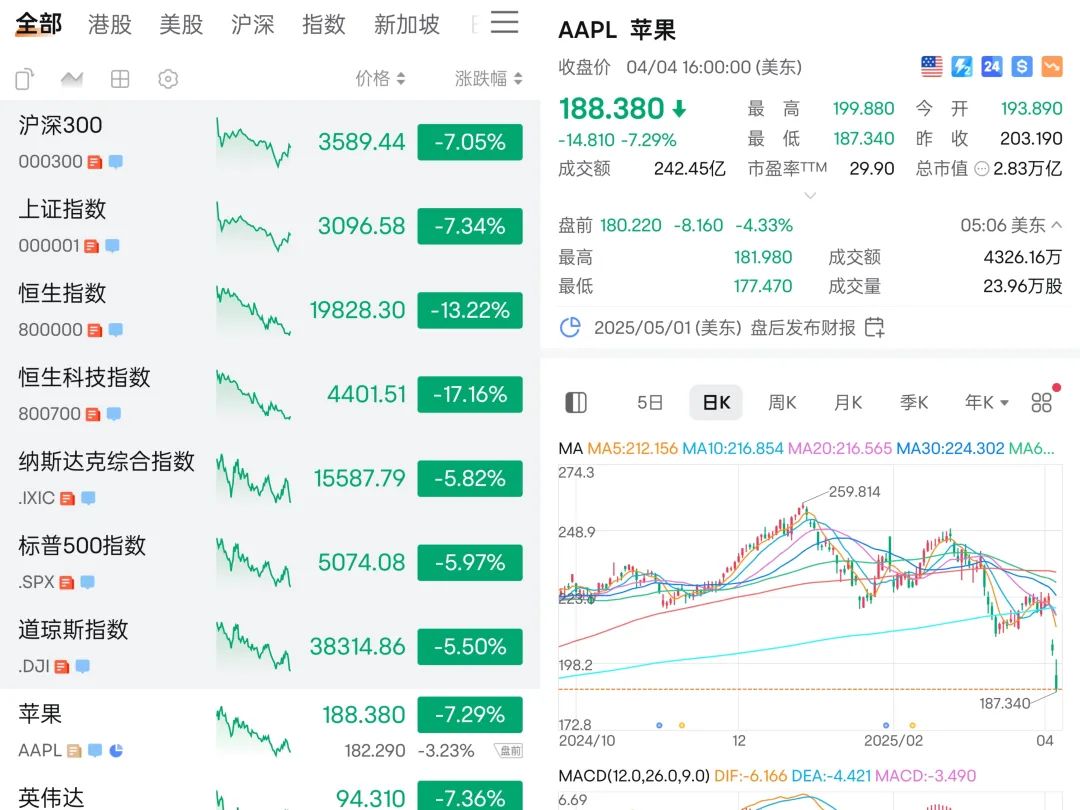

April 7th witnessed historic plunges:

- Shanghai Composite Index: -7.34%

- Shenzhen Component Index: -9.66%

- ChiNext Index: -12.5%

1.2 European and American Markets Follow Suit

Key indices showed sharp declines:

- DAX (Germany): -10%

- CAC40 (France): -6%

- FTSE 100 (UK): -5%

- Nasdaq (Pre-market): -3%

Post-announcement, US markets lost $6 trillion in two days, with tech stocks hardest hit. Apple’s market cap alone dropped $533.36 billion.

2. Apple’s Perfect Storm

2.1 Production Relocation Challenges

With 90% iPhones made in China facing 34% tariffs, alternative production hubs present new hurdles:

- India: 26% tariffs

- Vietnam: 46% tariffs

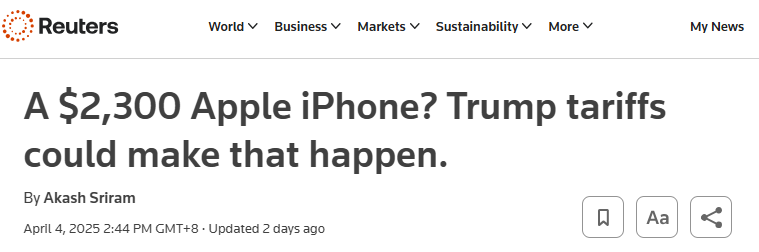

2.2 Price Hike Implications

Projected iPhone price increases:

- iPhone 16 Pro Max (US): $1,599 → $2,300

- Average series increase: 40%

2.3 Emergency Mitigation Strategies

- Deployed 5 cargo planes for urgent shipments

- Adopted ultra-slim packaging for transport optimization

- Negotiated supplier price reductions

3. Tariff Policy Face-Off

3.1 US Aggressive Stance

- Targets China, India, Vietnam

- Maximum 46% tariffs

- No Apple exemptions

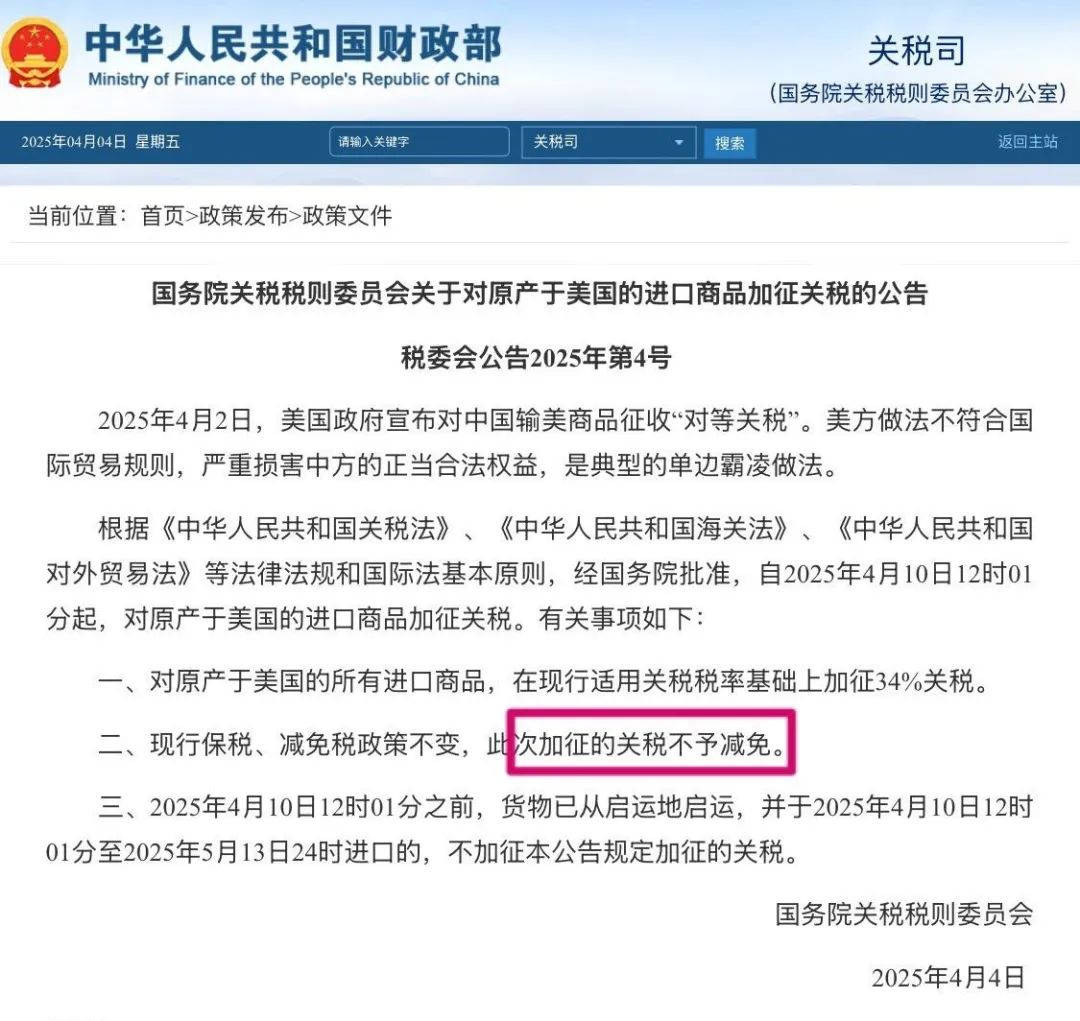

3.2 China’s Retaliatory Measures

- 34% reciprocal tariffs

- Bonded zone policies unchanged

- No tariff reductions

4. China Market Impact Analysis

4.1 Bonded Zone Advantages

Chinese iPhones benefit from:

- Temporary tariff exemptions for US components

- “Made in China” origin status

- Final VAT-only payment structure

4.2 Component Sourcing Map

- Displays: South Korea

- Camera Modules: Japan

- Chips: Taiwan

- Filters/Glass: USA (<15%)

4.3 Cost Transmission Analysis

- US component tariff impact: 7-10% cost increase

- Material costs: 40% of retail price

- Projected stable retail pricing

5. Consumer Action Blueprint

5.1 US Market Tactics

- Urgent upgrades: Consider cash purchases

- Monitor carrier discounts

- Explore certified refurbished options

5.2 China Market Strategies

- Normal demand: No need to stockpile

- Await e-commerce sales events

- Utilize trade-in programs

6. Industry Chain Reconfiguration

6.1 Supply Chain Shifts

- Southeast Asia orders +30%

- Automation demand +25%

- Logistics costs +18%

6.2 Competitor Moves

- Samsung: Mexico expansion

- Google Pixel: 40% production boost

- Huawei: European investment surge

7. Future Market Trajectories

7.1 Immediate Effects

- Global electronics prices: +20-35%

- Second-hand market growth: 50% surge

- Repair services: Expansion opportunities

7.2 Long-Term Evolution

- Multi-country production networks

- Modular design adoption

- Regional trade pact proliferation

Conclusion: Navigating the New Economic Reality

Trump’s tariff revolution is redefining global tech landscapes. While short-term disruptions cause price hikes and market volatility, they simultaneously accelerate supply chain diversification. For Chinese consumers, immediate iPhone price impacts remain buffered by bonded zone policies. Prudent consumption strategies aligned with actual needs are advised. The coming six months will be pivotal in assessing policy effectiveness and market adaptations. Stay informed through official channels for real-time updates.