“The EV market is unforgiving – one misstep can turn a rising star into a cautionary tale.” – Industry Analyst

1. Leadership Turmoil: Trust Erosion at the Top

1.1 CEO Exit Sparks Speculation

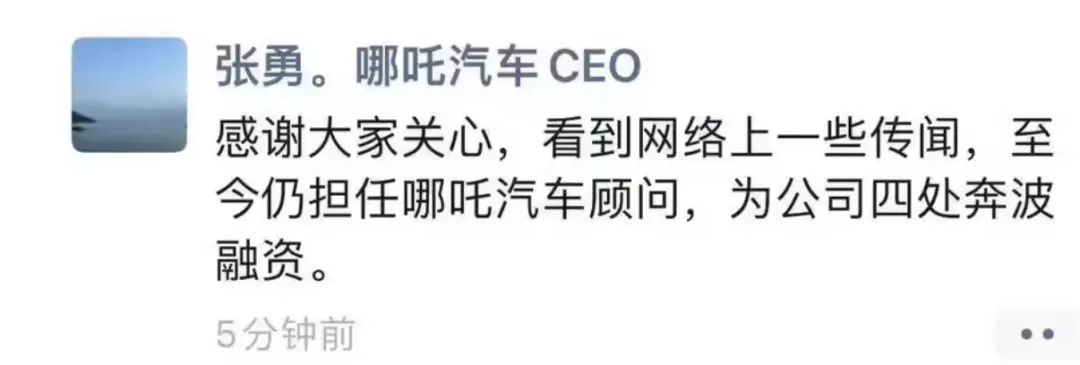

Zhang Yong’s December 2024 resignation as CEO – followed by reports of his prolonged UK stay – created a credibility vacuum. While he claims to be “fundraising abroad,” industry watchers question the optics of a leader seemingly distancing himself during crisis.

1.2 Brand Reputation Damage

The CEO saga overshadowed critical issues like dealership protests and financial woes. “Leadership instability accelerates market distrust,” notes auto analyst Li Ming. “Consumers need consistent messaging, not revolving-door executives.”

2. Financial Meltdown: Debt, Protests, and Layoffs

2.1 Crippling Debt Figures

- ¥3.45 billion ($476M) in frozen equity

- ¥160 million ($22M) in court-enforced liabilities

- ¥400 million ($55M) in unpaid wages and supplier bills

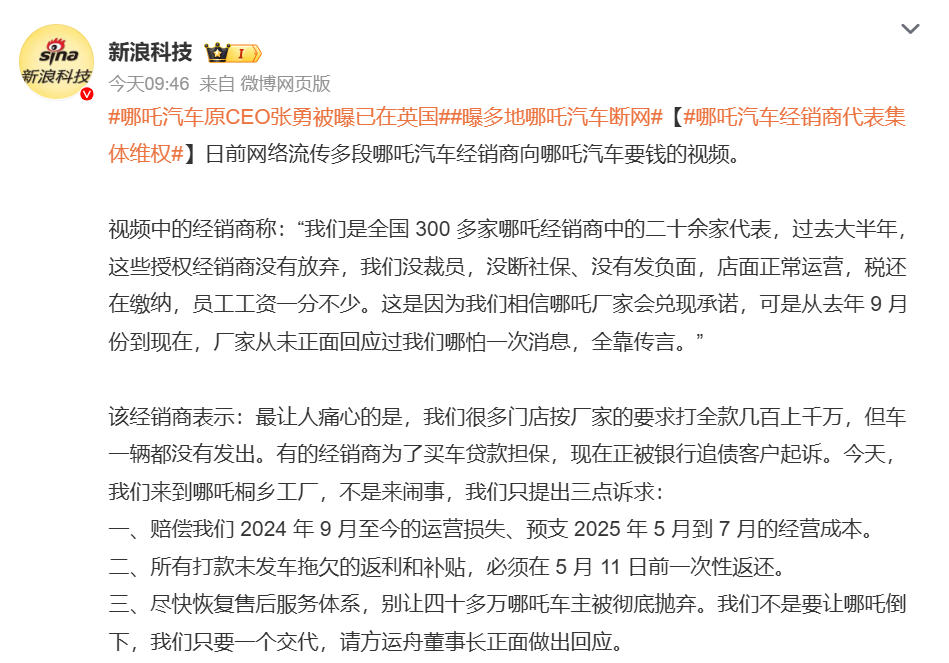

2.2 Dealer Rebellion

Since April 2024, dealers have protested:

- Unpaid subsidies exceeding $5M

- Hundreds of undelivered vehicles

- Collapsed after-sales support affecting 400,000+ owners

3. Market Freefall: From Darling to Underdog

3.1 Sales Nosedive

Domestic sales plunged 40% YoY in 2024. January 2025 saw just 110 units sold – a far cry from 2022’s peak as China’s top EV startup.

3.2 Premium Strategy Backfire

NEZHA’s attempt to pivot from budget models (V/U) to premium S/GT cars failed miserably. Pricing the S at ¥200,000+ ($27,600+) alienated its cost-conscious base, while competitors like BYD’s Seagull (¥70,000) dominated the affordable segment.

4. Southeast Asia Gambit: Thailand as Lifeline?

4.1 Strategic Partnerships

Securing a $273M credit line and 1,219 pre-orders in Thailand shows promise, but challenges remain:

- BYD and Geely’s entrenched dominance

- Weak brand recognition outside China

- Quality control concerns in new markets

5. Path to Survival: Funding, Transparency, Adaptation

5.1 Critical Funding Needs

CEO Fang Yunzhou’s goal of 2025 gross margin positivity requires immediate capital injection. Potential sources include:

- Government EV subsidies

- Strategic investor partnerships

- Asset sales

5.2 Industry Lessons

NEZHA’s struggles highlight key lessons:

- Avoid over-reliance on subsidies

- Maintain pricing consistency

- Prioritize dealer relationships

Competitor Analysis: How BYD and Tesla Dominate

BYD’s aggressive pricing and Tesla’s tech leadership squeeze NEZHA. Their vertical integration strategies – from battery production to retail networks – create economies of scale NEZHA lacks.

Regulatory Shifts: China’s EV Subsidy Phase-Out

Beijing’s gradual subsidy withdrawal exposed weaker players like NEZHA. Firms without self-sustaining models face existential threats, forcing consolidation in the overheated EV sector.