html

NIO Leadership Shakeup: Strategic Shift Behind Second Brand ‘Le Dao’

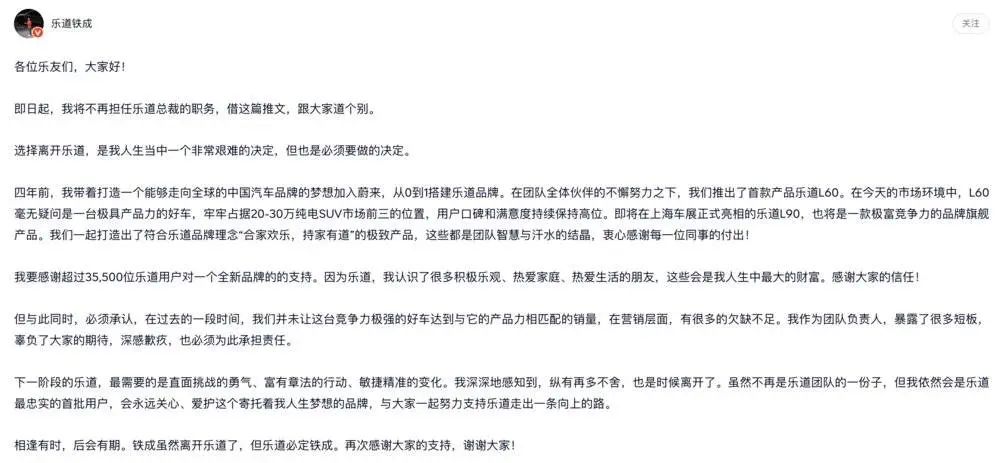

In China’s hyper-competitive electric vehicle (EV) market, leadership changes often signal deeper strategic realignments. The April announcement of a major leadership overhaul at NIO’s second brand, Le Dao, underscores the immense pressure facing the automaker as it battles for profitability and differentiation. Original president Ai Tiecheng’s departure due to unmet sales targets, replaced by senior executive Shen Fei, marks a critical inflection point. This article delves into the reasons behind this shift, upcoming challenges, and Le Dao’s roadmap to success.

1. Why Did Ai Tiecheng Leave? Sales Challenges Explained

Key Event Timeline

- Early March: Ai Tiecheng publicly stated, “No intention to abandon ship,” showing no signs of resignation.

- March 20: NIO initiated internal performance reviews for senior executives.

- April 2: Official announcement confirmed Shen Fei as Le Dao’s new president.

Sales Performance vs. Targets

- Store Expansion: Le Dao opened 450 sales outlets nationwide by March 2024.

- Delivery Numbers:

- January: 5,912 units

- February: 4,049 units

- March: 4,820 units

- Average Monthly Deliveries: ~4,900 units

- Shortfall: Le Dao aimed to exceed 10,000 monthly deliveries by Q1 2024 but achieved less than 50% of this target.

Core Issue

Rapid store expansion failed to translate into proportional sales growth, raising operational efficiency concerns.

2. Shen Fei’s New Strategy: Restructuring for Success

Organizational Changes

- Reporting Lines:

- Previously: Le Dao’s energy division reported directly to NIO CEO William Li.

- Now: Sales teams report to NIO President Qin Lihong, while Shen Fei oversees customer service.

- Key Responsibilities:

- Sales Operations: Full control over regional management and delivery systems.

- Battery Swap Integration: Linking sales with NIO’s battery swap network to enhance customer convenience.

- Product Oversight: CEO William Li now directly manages design and supply chain processes.

Strategic Priorities

- Cost Reduction: Merging Le Dao and NIO delivery channels could save 15% in operational costs.

- Resource Sharing: Sales teams now rotate across NIO brands to improve efficiency.

- Unified Goals: All departments align on Key Performance Indicators (KPIs) focused on Q4 2024 profitability.

3. Why Le Dao Must Succeed: NIO’s Survival Depends on It

NIO’s Main Brand Challenges

- Current Models: ES6, EC6, and ET5 series dominate the $34,500-$55,000 price range.

- New Product Gap:

- ET9 luxury sedan (starting at $103,000) targets niche markets.

- Firefly sub-brand focuses on premium compact cars with limited appeal.

- Delivery Target: NIO aims to sell 440,000 vehicles by 2024, requiring a 100% increase from 2023.

Le Dao’s Market Pressures

- Competitors: Tesla Model Y ($32,000), XPeng G6 ($35,000).

- Price Challenge: Le Dao’s L60 SUV starts at $38,000, higher than competitors in the $25,000-$35,000 EV market.

- Looming Threats: New entrants like Xiaomi’s SU7 and updated Tesla Model Y arriving by late 2024.

4. Breaking the Stalemate: Battery Swap Synergy

Battery Swap Network Advantages

- Infrastructure Goal: Install battery swap stations in every Chinese county by 2025.

- Sales Boost: Stores near swap stations see 30% higher sales; plans include bundling swap services with car purchases.

- Loyalty Programs: Exclusive charging packages for Le Dao owners to improve retention rates.

Channel Optimization

- Store Closures: Reducing outlets from 450 to 400 based on performance.

- Digital Tools: Upgraded VR test drives increased online conversion rates by 25%.

- Faster Turnaround: Adopting “build-to-order” reduced inventory cycles to 28 days.

5. Shen Fei’s Challenges & Opportunities

Main Obstacles

- Lack of Sales Experience: Shen Fei’s background is in energy, not automotive retail.

- Low Brand Awareness: 60% of target customers haven’t heard of Le Dao.

- Market Saturation: Over 15 EV models compete in the $25,000-$40,000 range.

Potential Advantages

- Battery Swap Edge: Le Dao can leverage NIO’s 2,400+ nationwide battery swap stations.

- Shared Resources: Using NIO’s R&D, factories, and service networks reduces costs.

- Untapped Markets: EV adoption in small cities remains below 20%, offering growth potential.

6. Industry Outlook: Survival of the Fittest

Intensifying Competition

- Tripartite Battle: Traditional automakers (e.g., BYD), EV startups (e.g., NIO), and tech companies (e.g., Xiaomi) vie for dominance.

- Price Wars: Brands add features without raising prices to attract buyers.

- Market Shakeout: Analysts predict 30% of EV brands will exit the market by 2025 due to losses.

Profitability Challenges

- High R&D Costs: Average $15,000 per vehicle, with slow returns.

- Thin Margins: Industry average gross margins below 15%; some brands sell cars at a loss.

- Funding Shortages: IPOs are rare, and investor patience is waning.

Strategic Pathways

- Premium Focus: NIO and Li Auto target luxury buyers.

- Affordable EVs: Brands like Leapmotor focus on sub-$20,000 models.

- Tech Differentiation: NIO bets on battery swapping, but policy and cost risks remain.

Conclusion

Ai Tiecheng’s departure marks a pivotal moment for NIO. Under Shen Fei’s leadership, Le Dao must not only revive sales but also prove that Chinese EV startups can adapt to market demands. Success hinges on fully leveraging NIO’s battery swap infrastructure, optimizing costs, and capturing small-city growth opportunities. As government subsidies wane and competition heats up, only brands delivering unique value will survive. For NIO and Le Dao, the innovation race has just begun.