Here’s the SEO-optimized HTML source code with images integrated into appropriate positions:

html

China’s Trillion-Dollar Fiscal Transfer Payments: Reshaping the Economic Landscape

The Chinese central government is implementing a fiscal transfer plan worth 1.48 trillion US dollars. This policy is profoundly changing the economic development model of each province. How is this amount of money, equivalent to the entire annual GDP of Canada, distributed? What economic effects will it have? This article will use simple and clear language to guide you through this complex fiscal system.

1. Three principles for allocating funds

China has a unique fiscal system called the “tax sharing system”. Local governments pay a portion of their tax revenue to the central government, which then redistributes it according to three core criteria:

- Population size: Provinces with large populations receive more funding for infrastructure

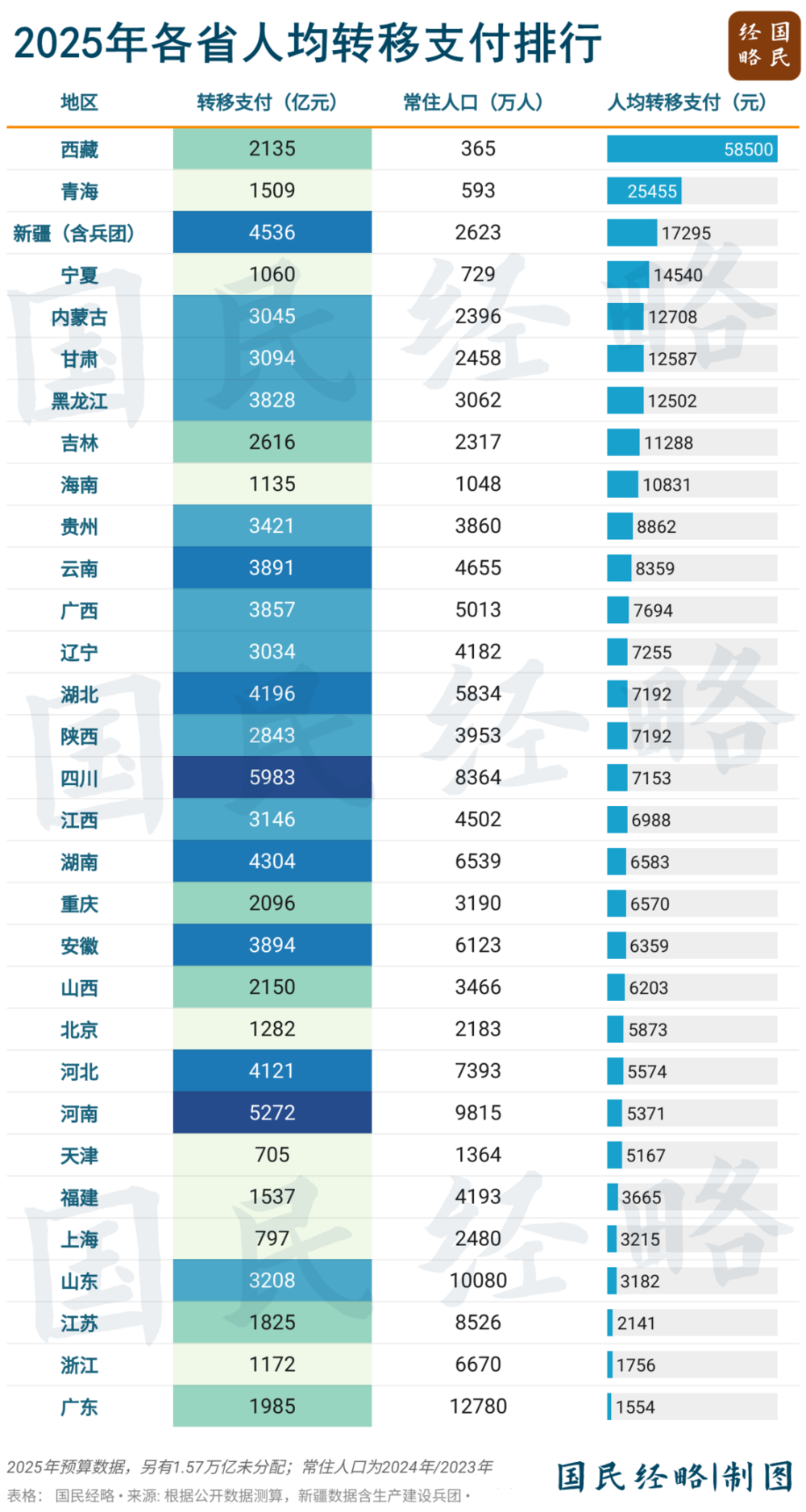

(Example: Sichuan received 85.5 billion US dollars, while Henan received 75.3 billion US dollars) - Economic level: Less developed regions receive more subsidies

(Typical case: Tibet received 7,150 US dollars per capita, followed by Qinghai and Xinjiang) - Strategic position: border areas and key development regions enjoy special support

(e.g. Xinjiang’s special infrastructure funding)

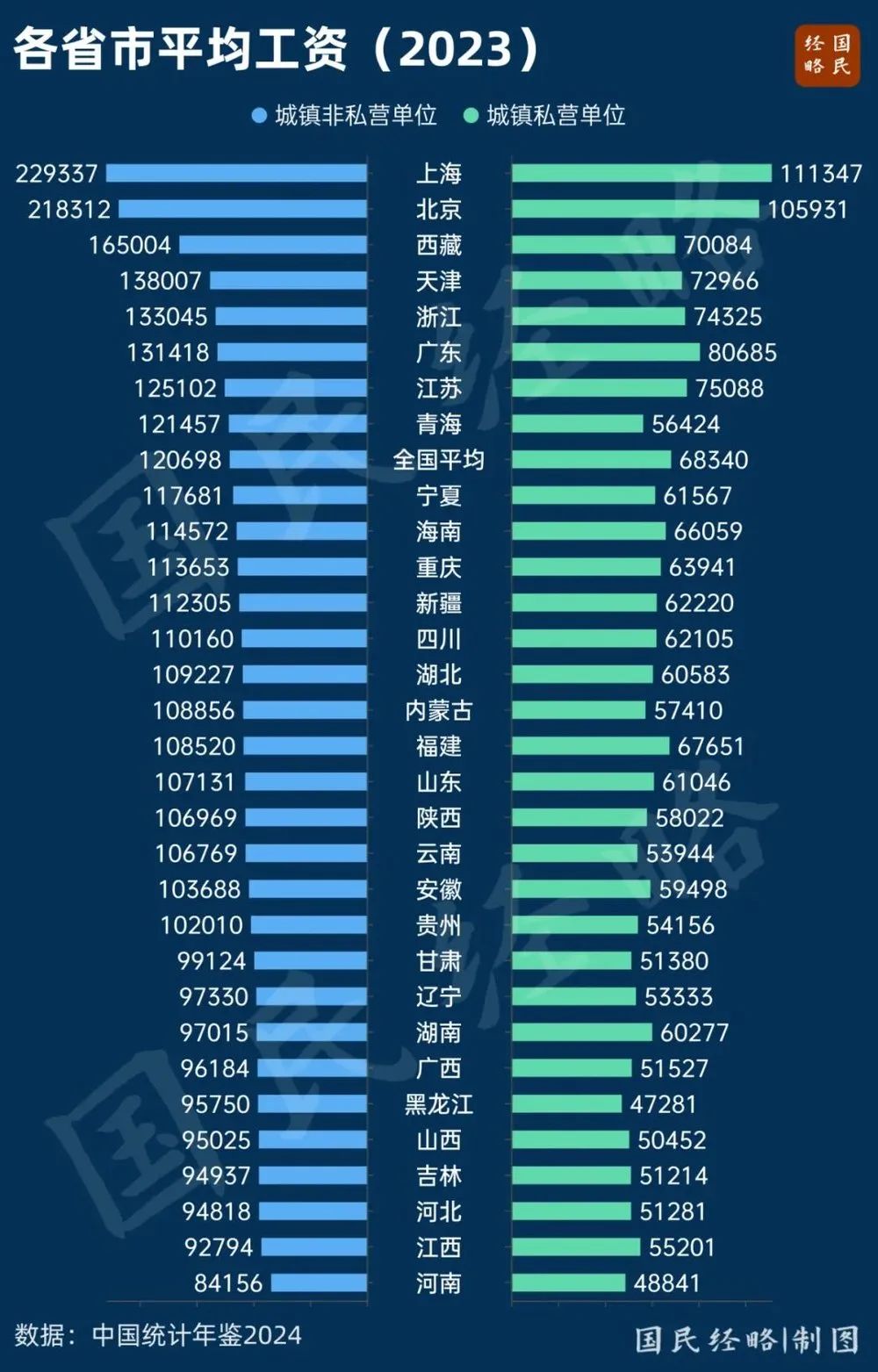

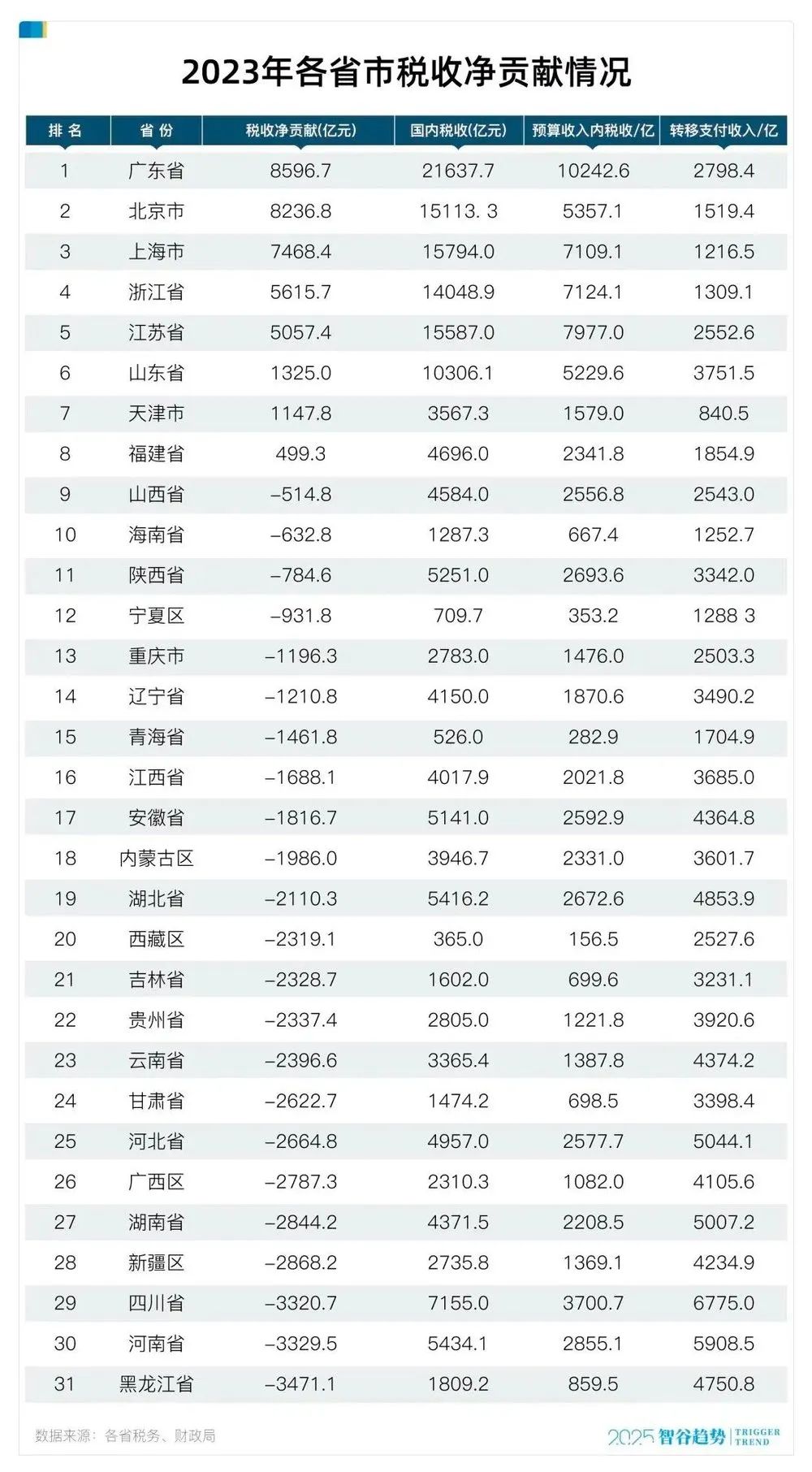

Strong provinces pay more and receive less:

- Guangdong Province pays 286 billion USD in taxes each year, but only keeps 143 billion USD

- Zhejiang Province’s 60% of tax revenue comes from private enterprises, but 43% of it is handed over to the central government

2. Per capita differences reveal deep-seated conflicts

Looking at per capita data can better reveal regional disparities:

- Tibetans receive 28 times the per capita subsidies of Guangdong residents

- Henan, Sichuan and other populous provinces receive about 600 US dollars per capita

- Shanghai, Beijing and other municipalities directly under the central government retain more than 3,000 US dollars per capita

This disparity has led to:

- A rapid improvement in the level of public services in border provinces

- Eastern residents questioning “whether the transfer payments are fair”

- Population mobility exacerbating the pressure on fiscal distribution

3. The financial contribution of the eight eastern provinces

The coastal regions bear the main burden of the country’s finances:

First echelon:

- Guangdong (contributing an amount equivalent to Indonesia’s military budget)

- Shanghai (outstanding contribution from the financial industry)

- Jiangsu (manufacturing industry accounts for 70% of tax revenue)

Second echelon:

- Shandong (petrochemical industry supports fiscal revenue)

- Fujian (annual growth of 25% in digital economy tax revenue)

Special phenomenon:

- Zhejiang Province contributes tax revenue of 480,000 USD per square kilometer of land

- Shenzhen City’s annual tax revenue from a single enterprise exceeds 20 billion USD

4. Policy controversy

The policy has triggered heated discussions between two camps:

Supporters believe that

- √ compensation for the historical development deficit in the Midwest

- √ investment is needed to maintain border security

- √ a necessary means to achieve “common prosperity”

Skeptics point out that

- × the efficiency of fund use needs to be improved

- × some provinces have a dependency mentality

- × the development momentum of economically strong provinces may be restricted

Comparison of actual cases

- Guizhou Province received subsidies to build a data center and cultivate new industries

- Shanxi Province uses some of its transfer payments to compensate for the closure of coal mines

- Yunnan Province uses 92% of its border port construction funds

5. The three major challenges ahead

As the policy deepens, new problems continue to emerge:

Upgraded capital supervision:

- Electronic monitoring systems track the flow of every fund

- Pilot application of blockchain technology

- The rate of investigation and punishment for illegal use has increased to 98

Performance evaluation reform:

- Introduce third-party evaluation agencies

- Establish an “input-output” analysis model

- Inclusion of job creation as a performance indicator

Debt risk management:

- Qinghai Province’s debt ratio reached 82% (32% above the international warning line)

- Some counties and cities in Guizhou Province suspended infrastructure projects

- The Ministry of Finance established a debt warning “red and yellow light” mechanism

6. Ordinary people’s real feelings

The impact of policies can be seen through three typical cases:

- Tsering, a Tibetan herdsman: the medical reimbursement ratio increased from 40% to 85

- Dongguan factory worker Zhang Wei: pays an extra 30,000 USD in tax each year

- Zhengzhou university student Li Fang: two vocational training schools have been built in her hometown

Field research findings:

- Road accessibility in the western region has increased by 61

- Eastern enterprises feel an increased tax burden

- Subsidy-dependent counties have emerged in the central region

7. International comparative analysis

Comparison with the fiscal systems of other major countries:

US model:

- Federal subsidies account for about 30% of state finances

- Focus on education and healthcare

- More transparent allocation formula

German experience:

- Horizontal transfer payment system

- Wealthy states directly subsidize less developed states

- Sound dispute resolution mechanism

Japanese approach:

- Delivery tax system

- Special subsidies for mountainous areas and islands

- Regular public disclosure of fund use

Key differences with Chinese characteristics:

- Greater central control

- Higher weight of strategic considerations

- More flexible policy adjustments

8. Corporate response strategies

Response strategies for different types of enterprises:

Manufacturing industry:

- Relocate production bases to the central and western regions

- Apply for industrial transfer subsidies

- Participate in local PPP projects

Technology companies:

- Seek preferential electricity prices for western data centers

- Participate in smart city construction projects

- Take advantage of local talent subsidy policies

Foreign trade enterprises:

- Pay attention to the construction progress of border crossings

- Apply for cross-border logistics subsidies

- Layout the land port economic zone

9. Changes in people’s lives

The day-to-day impact of fiscal transfers:

Price fluctuations:

- Western vegetable prices have fallen by 23

- Prices in some service industries in the east have risen

- The national electricity price difference has narrowed to 8

Employment market:

- 1.8 million new infrastructure jobs in the west

- A skills shortage in the east

- Telecommuting jobs have increased by 400

Public services:

- The CT equipment penetration rate in hospitals in the west has increased to 75

- Subway construction in the east has slowed

- National social security standard gap narrows

10. Future trend prediction

Three possible directions based on the current situation:

Optimistic scenario:

- Regional disparities narrow to a reasonable range

- A virtuous financial cycle is formed

- New economic growth poles are cultivated

Neutral expectations:

- The eastern region’s growth rate moderates moderately

- The central region continues to rise

- The benefits of infrastructure construction in the western region become apparent

Risk scenario:

- Some provinces default on debt

- The relocation of enterprises in the eastern region accelerates

- Resurgence of corruption in the use of funds

Conclusion: This policy is rewriting the regional economic map of China. It not only affects the wallets of the 34 provincial-level administrative regions, but also the daily lives of 1.4 billion people. The next time you see a newly built highway in the west, or hear about the expansion of a business in the east, you might want to think about the financial logic behind it. This experiment of the largest fiscal transfer in human history is still ongoing.