html

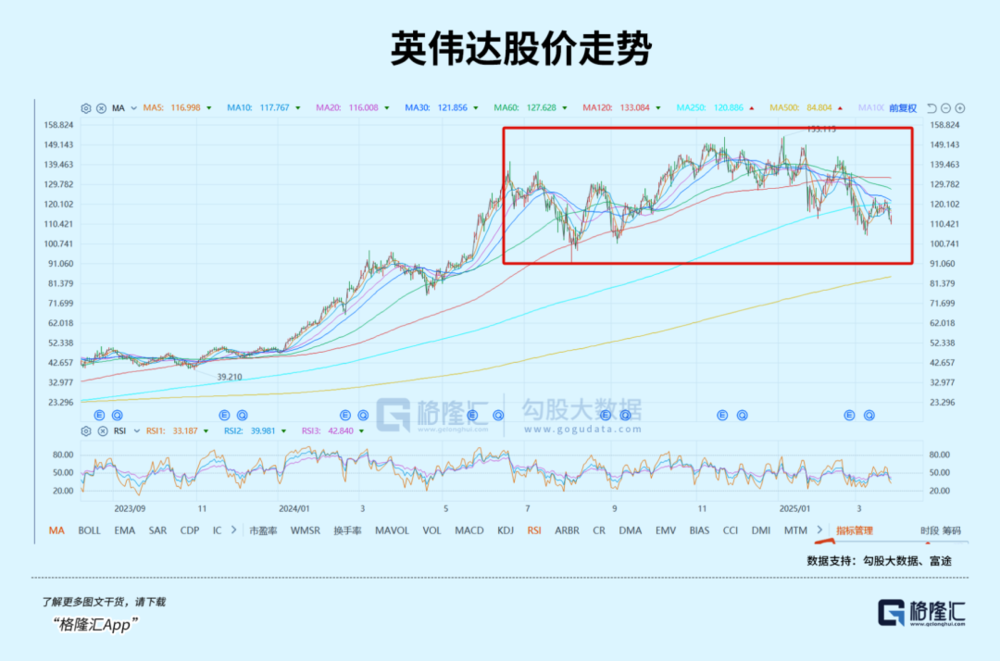

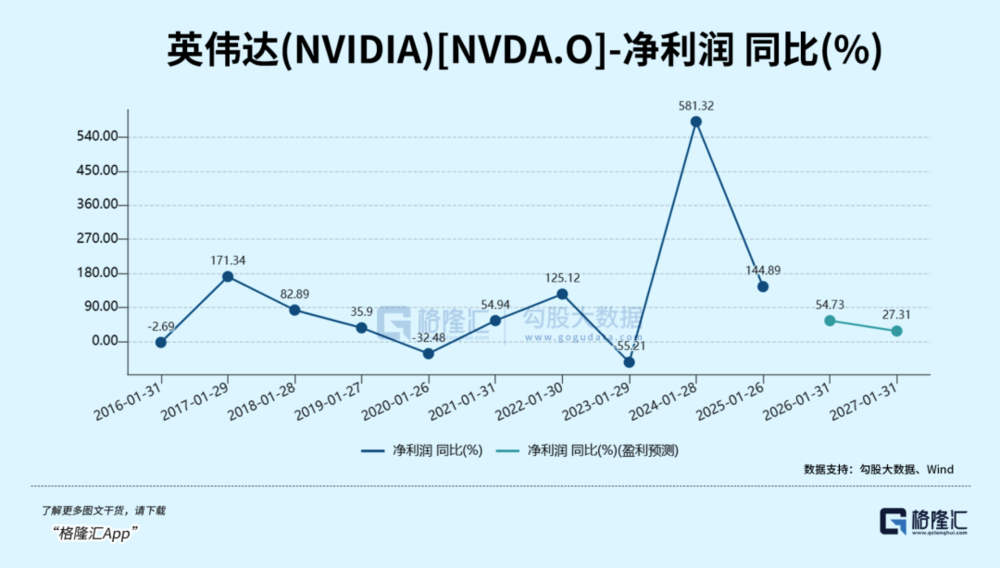

In the ever-shifting landscape of global technology, NVIDIA faces unprecedented challenges. Since hitting its peak in January 2024, the company’s market value has plummeted over 20%, making it the second-largest US tech giant to falter after Tesla. This comprehensive analysis dives deep into the factors impacting NVIDIA’s stock price and offers practical guidance for investors seeking clarity in these turbulent times.

1. Geopolitical Storm Rocks H20 Chip

NVIDIA’s flagship H20 high-performance chip, designed for the Chinese market, faces dual challenges:

- Escalating U.S. export controls restricting sales to Chinese firms like Inspur Group

- New Chinese energy efficiency regulations blocking H20 use in data centers

Morgan Stanley estimates a complete Chinese market exit could slash NVIDIA’s annual revenue by $17 billion, equivalent to 13% of FY2024 revenue, heightening investor concerns over supply chain stability.

2. Data Center Slowdown Triggers Chain Reaction

Early signs of global data center market imbalance emerge:

- Microsoft cancels major 2GW U.S./Europe data center projects

- Goldman Sachs slashes 2025 AI server shipment forecasts by 39%

Analysts warn current construction paces exceed actual demand, prompting companies to reassess AI infrastructure ROI cycles.

3. AI Infrastructure Bubble Risks Emerge

Industry leaders sound early warnings:

- Alibaba’s Cai Chongxin highlights U.S. data center overinvestment

- CoreWeave IPO valuation drops 28% from $32B to $23B

Deutsche Bank reports Q1 2024 global AI infrastructure investment fell 17% QoQ, marking the first negative growth in three years.

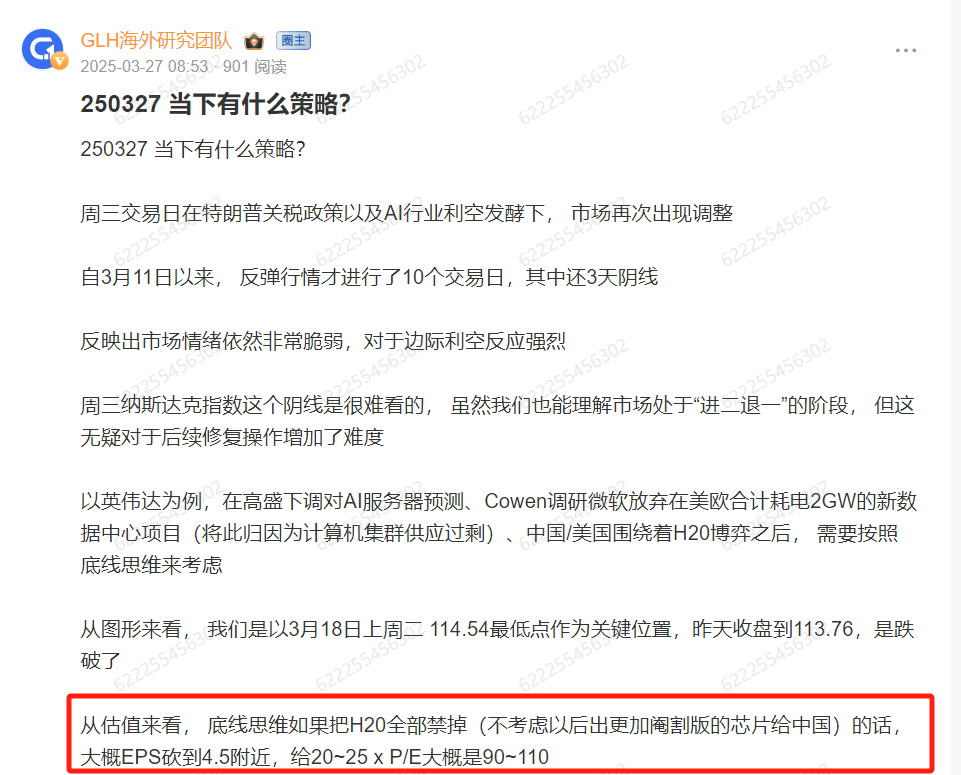

4. Profitability and Valuation Double Pressure

Market expectations shift dramatically:

- 2025 EPS forecasts cut from $6.2 to $4.5

- P/E ratio drops from 30x to 20-25x range

At $111.43 on April 30, NVIDIA’s stock hovers near its reasonable valuation upper limit ($90-$112), suggesting limited short-term upside without new breakthroughs.

5. AI Transformation Opens New Opportunities

Amid challenges, NVIDIA holds critical AI upgrade keys:

- Inference computing demand expected to exceed training by 2025

- CUDA platform maintains 78% developer community penetration

Citi analysis shows dedicated chips for video generation/3D modeling could unlock a $20B market.

6. Quantitative Decision-Making Guide

Recent fluctuations reveal key patterns (evidenced by Xiaomi/Tesla cases):

- Stocks often rebound when PEG < 1.2x

- Institutional positioning changes better reflect trends than media

Track These Core Indicators:

- Quarterly R&D investment >15% of revenue

- Data center gross margins >70%

- U.S. 10-year Treasury yield impact on tech valuations

7. Balanced Risk-Opportunity Strategy

Tailored advice for different investor types:

Long-Term Holders:

- Maintain ≤8% portfolio allocation

- Quarterly check of core indicators

Short-Term Traders:

- Grid trade $90-$112 range

- Watch for volume >200% 50-DMA

Wait-and-See Investors:

- Diversify via semiconductor ETFs (e.g., SOXX)

- Monitor June GTC conference roadmap

NVIDIA’s challenges mirror tech industry transformation pains – intertwined effects of geopolitics, tech cycles, and capital flows. Investors need:

- Microscope for quarterly financial details

- Telescope for AI’s long-term trajectory

- Thermometer for market sentiment shifts

Historical data shows tech giant corrections last 6-18 months. Peak market fear often signals optimal positioning for next growth phases.

Data Appendix

- 1GW data center ≈ 150,000 standard servers

- Global AI chip market: $45B (2023) → $120B (2027 forecast)

- Inference computing energy use: 40-60% lower than training

(Data current as of April 30, 2024. Not investment advice.)